All Categories

Featured

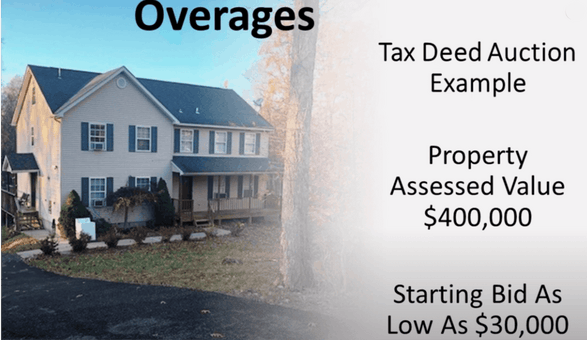

Tax Sale Overages Tax Obligation Auction Overages Before the choice by the Court, Michigan was amongst a minority of states that permitted the retention of surplus benefit from tax-foreclosure sales. Residential or commercial property owners that have really lost their residential property as an outcome of a tax obligation repossession sale currently have a case versus the area for the distinction between the amount of tax responsibilities owed and the quantity recognized at the tax responsibility sale by the Region.

In the past, miss out on tracing was done by debt enthusiast and personal detectives to find people that where avoiding a debt, under investigation, or in issue with the regulations.

Below is a list of the most usual customer inquiries. If you can not discover a response to your question, please do not think twice to get to out to us. Who is called for to file tax overages hands-on pdf? All people who are needed to file a federal earnings tax obligation return are also required to submit a tax overages guidebook.

Depending on their declaring status and income degree, some people may be called for to submit a state income tax obligation return. Just how to fill up out tax overages manual pdf?

Complying with the instructions on the kind, fill up out all the fields that are appropriate to your tax obligation situation. When you come to the area on declaring for tax obligation excess, make sure to supply all the details needed.

4. Once you have completed the form, make sure to double check it for precision prior to sending it. 5. Send the type to the appropriate tax obligation authority. You will normally need to mail it in or submit it online. What is tax obligation excess hands-on pdf? A tax excess manual PDF is a paper or guide that supplies info and guidelines on just how to find, gather, and insurance claim tax overages.

Who Pays Property Taxes On Foreclosed Homes

The excess amount is usually reimbursed to the proprietor, and the manual offers advice on the process and procedures associated with declaring these reimbursements. What is the function of tax overages hands-on pdf? The purpose of a tax excess hands-on PDF is to provide details and guidance associated to tax obligation overages.

Tax obligation Year: The particular year for which the overage is being reported. Amount of Overpayment: The total amount of overpayment or excess tax paid by the taxpayer. Resource of Overpayment: The reason or source of the overpayment, such as excess tax obligation withholding, estimated tax obligation payments, or any type of other relevant resource.

Foreclosure Property Taxes Owed

Refund Request: If the taxpayer is asking for a refund of the overpayment, they require to indicate the total up to be refunded and the favored technique of reimbursement (e.g., direct deposit, paper check). 6. Sustaining Papers: Any relevant sustaining records, such as W-2 kinds, 1099 kinds, or various other tax-related invoices, that confirm the overpayment and warrant the refund request.

Signature and Date: The taxpayer should authorize and date the document to license the precision of the info offered. It is essential to keep in mind that this information is generic and might not cover all the certain requirements or variants in various regions. Always seek advice from the relevant tax authorities or consult a tax obligation professional for exact and up-to-date information pertaining to tax excess reporting.

Latest Posts

How To Invest In Tax Lien Certificates

Struck Off Property

Tax Lien Investing Pros And Cons